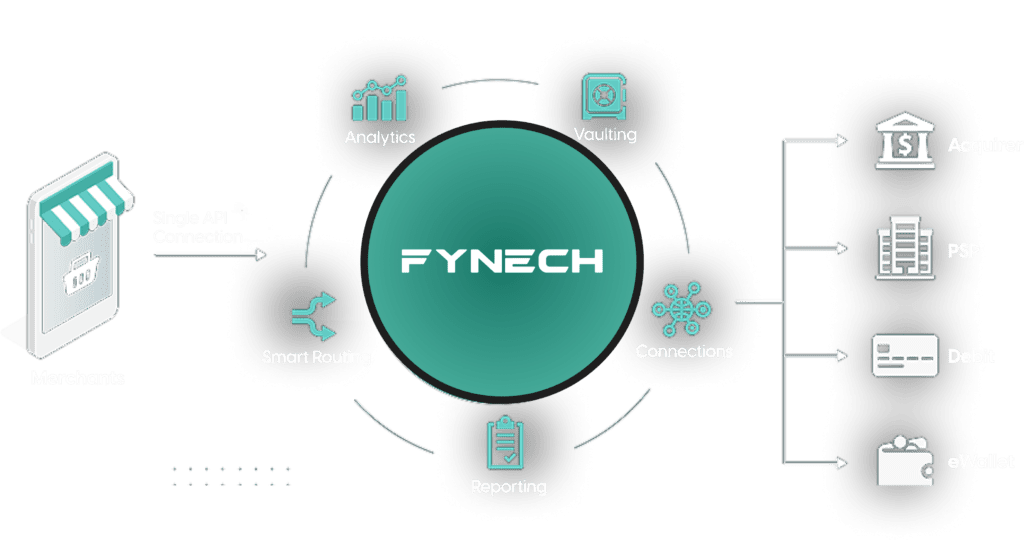

All Payments,

One Integration.

A seamless payment orchestration platform that empowers businesses to thrive in the digital economy.

We come with the features you need

A seamless payment orchestration platform that empowers businesses to thrive in the digital economy.

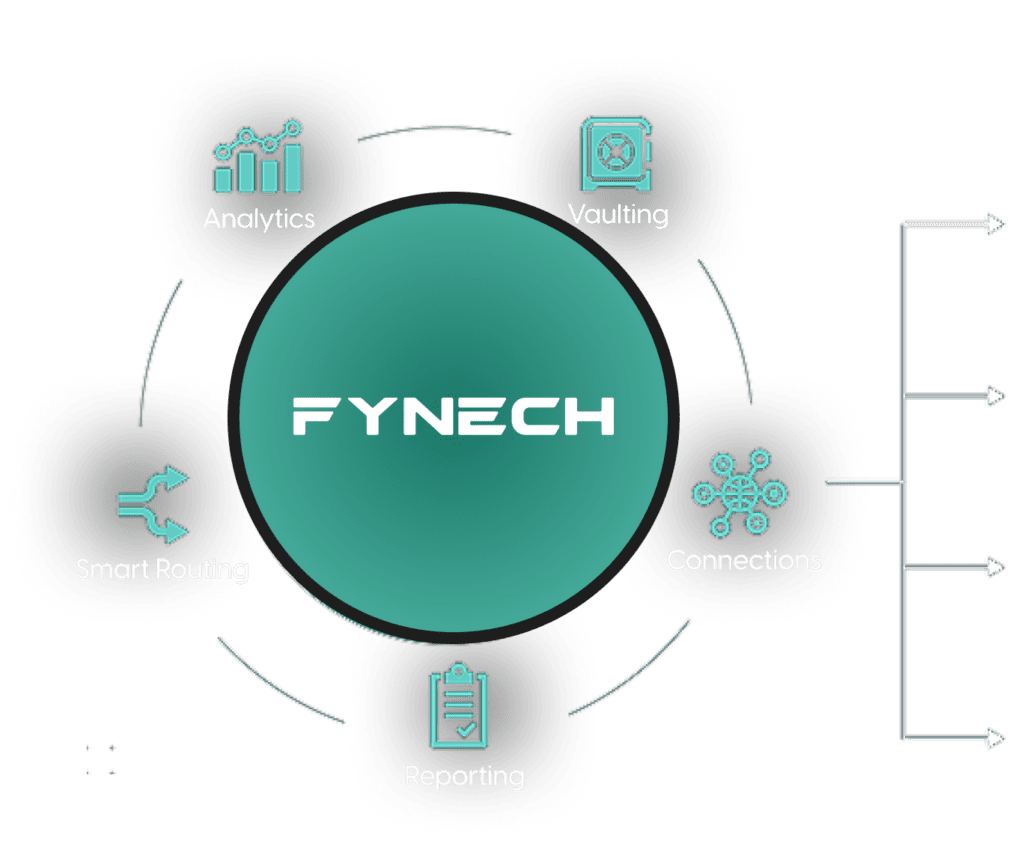

Simplified Integration

One time integration with our platform lets you connect all your payment methods easily.

Multiple Payment Options

Access a variety of payment options, including credit cards, eWallets, and more, catering to all customer preferences.

Enhanced Security

Advanced security measures protect your transactions and customer data with encryption and fraud detection.

Real Time Analytics

Get insights into your payment transactions with real time reporting to help make informed decisions.

Dynamic Currency Conversion

Seamlessly process payments in various currencies with real time exchange rates.

Customer Support

Dedicated support team ready to assist you with any payment processing issues.

How It Works

Fynech offers merchants the flexibility to choose the most convenient way to integrate payments into their business, with minimal effort and no technical barriers.

A popup on top of your website with almost no coding needed. No redirects, just seamless integration.

Add a payment page directly to your site as an iFrame, providing a frictionless, on-site experience.

Generate payment links and send them to your customers to complete purchases, perfect for offsite or remote payments.

Why Choose Fynech?

Fynech is designed to streamline your payment processes and boost your business performance. Here’s how we empower merchants like you:

Merchants only need one integration with Fynech's API and SDK, avoiding multiple payment provider integrations.

Fynech scales with growing businesses, handling increased transaction volumes without system changes.

Fyntech offers a broad selection of domestic and international payment options to expand customer reach.

A streamlined payment process improves customer satisfaction and loyalty.

Optimized payment routes boost transaction success and minimize failed payments.

Merchants can focus on their core business, while Fynech manages the complexity of payment systems.

Advanced security measures and fraud detection ensure safe transaction handling.

Fynech helps merchants stay compliant with local and international payment regulations.

Merchants receive real-time data and reports for better sales tracking and business decisions.

Merchants can tailor payment features to fit their unique business needs.

Fynech optimizes payment routes, reducing processing fees and consolidating services.

Fynech offers dedicated support for quick issue resolution and smooth payment operations.